The Paradox of the “Poor” Currency

A Strategic Lever for Self-Reliance

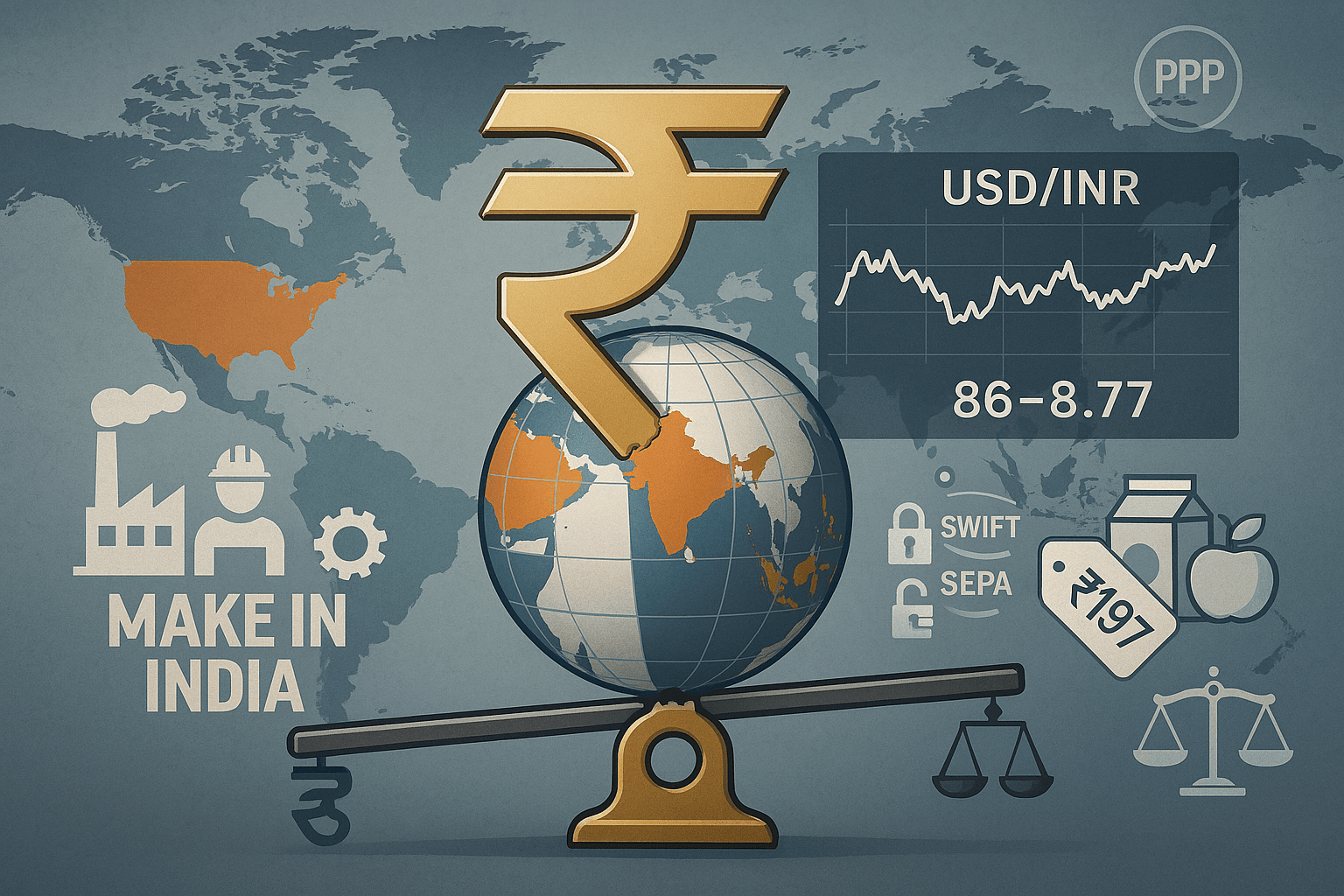

When outsiders observe the Indian Rupee’s nominal exchange rate against the US Dollar, often hovering around ₹86-87 per USD as of mid-2025, it is commonly dismissed as a “poor” currency indicative of economic weakness. Yet this perception is a classic example of chirag tale andhera — “darkness under the lamp” — obscuring a profound truth about India’s underlying economic resilience. The Rupee, far from being a liability, paradoxically serves as a strategic asset, a unique “yellow rose” that has helped India chart a path towards self-reliant growth.

To understand this paradox, one must consider the broader global financial architecture. Many national currencies are, implicitly or explicitly, maintained at lower nominal values relative to the US Dollar—a reflection of the Dollar’s “exorbitant privilege” as the world’s primary reserve and trade currency. This dominant status allows the US to finance large consumption and deficits by issuing treasury bills widely accepted worldwide. Such a structure creates an asymmetry where other currencies often appear undervalued against the Dollar in nominal terms.

However, when we assess India by Purchasing Power Parity (PPP)—an economic measure adjusting for relative price levels—the story changes significantly. India ranks as the world’s third-largest economy by PPP, highlighting the vast disparity between nominal exchange rates and actual domestic buying power. PPP effectively measures what a unit of currency can purchase within the local economy, clarifying why a “low” nominal rate does not imply economic weakness.

For India, this nominal undervaluation confers a remarkable competitive advantage. A weaker Rupee makes manufacturing within India much more affordable in dollar terms, as costs for labor, land, and inputs are comparatively low. This intrinsic cost advantage acts as a powerful magnet for both foreign direct investment (FDI) and domestic firms targeting export markets, helping to expand India’s role in global supply chains.

This economic reality underpins initiatives such as “Make in India,” especially in sectors like defense manufacturing, where import substitution is not only a matter of national pride but an economic imperative. With a weaker currency, importing high-value goods becomes significantly costlier, straining foreign exchange reserves and worsening trade deficits. Without aggressive localization efforts, India risked greater fiscal vulnerabilities. Thus, the Rupee’s “poor” status ironically propels the nation toward greater self-reliance and economic robustness.

In addition, the weakened nominal exchange rate translates into an exceptionally high domestic purchasing power for many Indians. Despite a seemingly low nominal income, the cost of essentials—like meals or daily goods—is remarkably affordable. For example, a wholesome meal for three persons or heavy snacks for six from a reputable Indian establishment can cost around ₹197 (approximately US$2.29), even including perks such as near-free delivery for premium loyalty members. This means that modest nominal incomes often yield quality living standards within India. As the saying goes, one can “earn little and live like kings.”

SWIFT and SEPA

Nonetheless, it is important to recognize that currency valuation is not governed by economic fundamentals alone. Global financial infrastructure platforms like SWIFT (Society for Worldwide Interbank Financial Telecommunication) and the Single Euro Payments Area (SEPA) serve as critical arteries for cross-border currency flows. While fundamentally designed as neutral payment messaging systems, their operational control and accessibility can be leveraged geopolitically. For instance, the exclusion of certain nations from SWIFT has effectively restricted their international capital flows. Such restrictions can limit demand or supply of affected currencies, thereby exerting indirect, artificial pressure on their valuations. Although these systems do not directly set exchange rates, control over transaction flows and access to global liquidity markets arguably allow influential powers to mold valuation dynamics beyond pure market fundamentals.

Of course, a nominally weaker Rupee does carry some risks, such as raising the cost of imported capital goods or inflationary pressures from expensive external inputs. The Reserve Bank of India (RBI) continually adjusts monetary policy to balance these effects and maintain inflation within targeted ranges, preserving currency stability and protecting domestic purchasing power.

Conclusion:

In conclusion, the Indian Rupee, despite its low nominal exchange rate, is far from “poor” in strategic utility or domestic strength. It acts as a critical lever incentivizing domestic production, reducing costly imports, nurturing self-reliance, and delivering quality of life benefits for its citizens. This paradox is a core pillar of India’s multifaceted economic strategy—a “poor” currency that paradoxically empowers a rich and resilient economy.